Aave (AAVE) has been on a bearish run all year long, with the value lowering by round 85% within the first two quarters. The value of AAVE went as little as $45 in June, which was the bottom in virtually 9 months. Nonetheless, after discovering support in that space, AAVE began to extend. Through the summer time months of this yr, AAVE elevated by round 160%, indicating a reversal within the long-term development. Nonetheless, the value encountered resistance at round $115, and it has been on the decline ever since that.

Just lately, the value of AAVE has been on the rise. In the previous couple of days alone, AAVE has elevated by round 30%, making it the most effective performers of the week. This improve reveals that AAVE has penetrated the higher trendline of the descending wedge, indicating that the development may reverse within the coming weeks.

However earlier than making predictions on how AAVE could carry out within the quick run, we should look via technical and basic components which will have an effect on the value of AAVE.

Aave (AAVE) Technical Evaluation

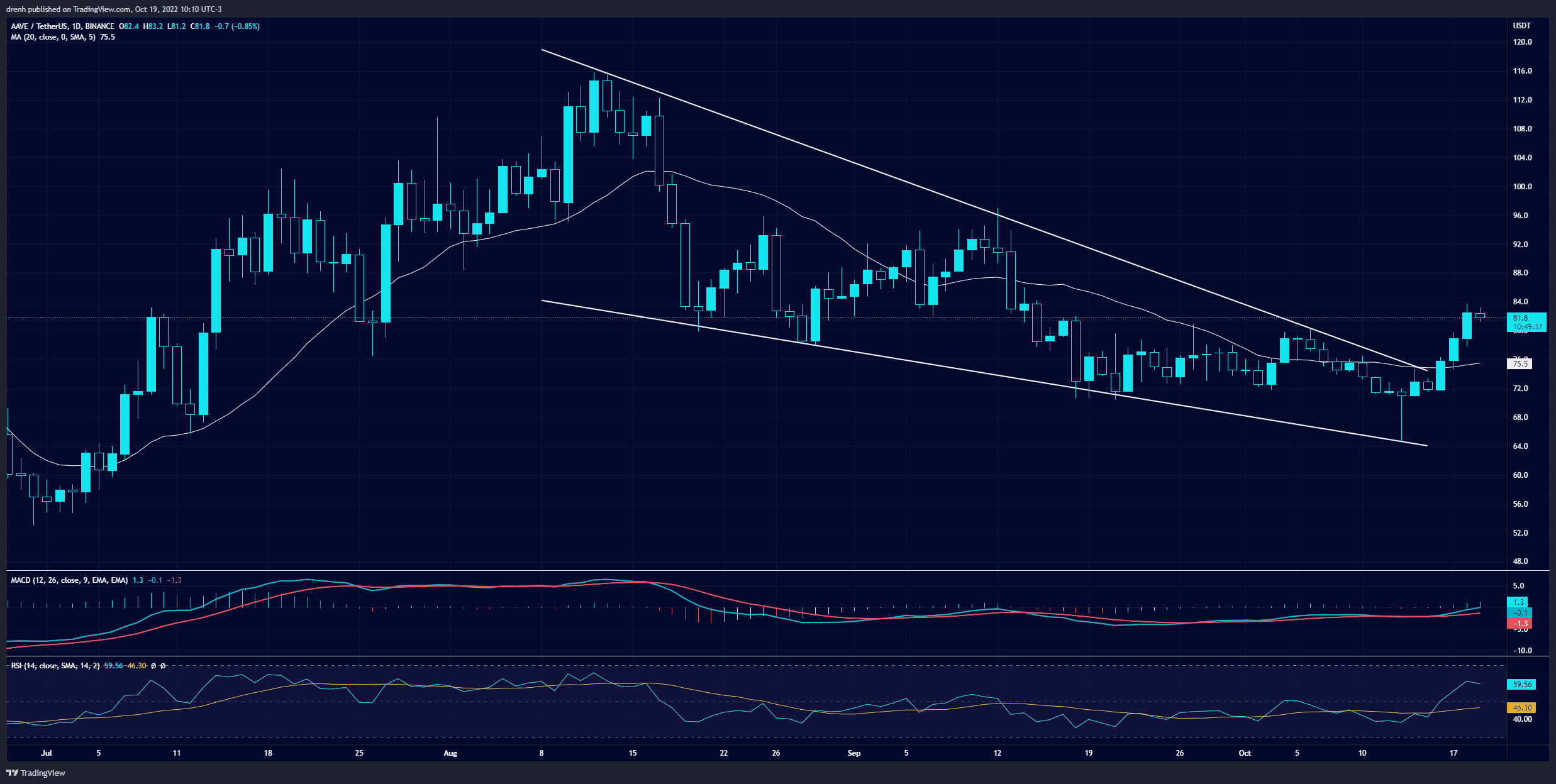

As could be seen within the AAVE/USDT 1-day chart, the value of AAVE had a breakout of 30%, which hinted at a possible bullish reversal within the chart. Whereas the long-term chart nonetheless stays bearish for AAVE, the current worth motion has considerably improved the market sentiment.

AAVE merchants have been fast sufficient to withdraw funds as a result of current improve because the promoting strain has barely elevated. This created a resistance construction at $84. At the moment, AAVE is on the verge of retracement, different issues equal.

Fibonacci retracement ranges of the current worth motion recommend that the value of AAVE may have robust help at 23.6% and 61.8% ranges, respectively.

Indicators

The worry and greed index of the 1-day chart means that AAVE merchants recommend that the index has barely improved. There may be nonetheless excessive worry available in the market, nonetheless, given the present state of BTC and different altcoins.

The RSI of a 1-day chart means that it has considerably improved just lately. It’s above 50, that means that the shopping for strain is comparatively excessive and that there’s area for development for AAVE within the coming days.

The MACD line of a 1-day chart is above the sign line and the baseline as a result of current improve within the worth. The present momentum is bullish for AAVE, however the strains could quickly converge if a retracement happens.

The 20-Day MA is beneath the present worth of AAVE, that means that the development is now bullish, different issues equal. The identical applies to the 9-Day EMA, which may additionally act as a pure help to the value of AAVE if the latter retraces.

Aave (AAVE) Basic Evaluation

Just lately, Justin Solar, the founding father of Tron, reportedly withdrew round $50 million value of USDT from the Aave ecosystem and transferred them to a Poloniex-funded tackle. Due to that, the full provide of USDT within the AAVE/USDT pool has declined to round $250 million, which might be alarming to AAVE whales.

#PeckShieldAlert The $USDT within the Aave Pool has dropped from $300M to $250M, -17% pic.twitter.com/oPe7DLBqVI

— PeckShieldAlert (@PeckShieldAlert) October 17, 2022

To offer slightly extra context on this, Justin Solar was banned by the Aave ecosystem after somebody reportedly despatched 0.1 ETH to his tackle from a suspicious pockets from Twister Mixer.

I’m formally blocked by @AaveAave since somebody despatched 0.1 eth randomly from @TornadoCash to me. @StaniKulechov pic.twitter.com/tNXNLNYZha

— H.E. Justin Solar🌞🇬🇩🇩🇲🔥 (@justinsuntron) August 13, 2022

Many anticipated that this might have a unfavourable impression on the value of AAVE since somebody corresponding to Solar is very influential. To help this, Huobi Token has grown massively just lately after it was introduced that Solar is formally concerned with the venture.

Nevertheless, the value has as an alternative elevated just lately. Due to this fact, this means that AAVE is solely not that affected by “large sport” influencers.

In different information, Aave is launching its personal stablecoin often known as GHO. GHO goals to resolve the stablecoin trilemma of capital effectivity, worth stability (collateralization), and decentralization.

For extra particulars, take a look at the brand new updates on the event of GHO:

The Aave Corporations have supplied an replace on the event of GHO. This consists of the GHO technical paper and particulars on the primary GHO audit. Learn extra right here 👉 https://t.co/VqQvIBG5pH

— Aave (@AaveAave) October 14, 2022

AAVE Value Prediction

Primarily based on this worth evaluation on Aave (AAVE), the value of AAVE may improve within the coming days as a result of current worth breakout. We may count on the value of AAVE to purpose for $125 within the coming weeks, different issues equal.

Takeaways

- Aave (AAVE) has elevated by 30% in the previous couple of days.

- Latest AAVE worth breakout hints at a potential bullish momentum for the approaching weeks.

- Justin Solar reportedly withdrew $50 million from the AAVE blockchain.

- Aave is launching its extremely anticipated stablecoin, $GHO.

- AAVE may purpose for $125 within the coming weeks.