All through 2022, Maker (MKR) has been in a downtrend, which is to be anticipated provided that the entire crypto market has been bearish. The value of MKR has declined by round 80% for the reason that starting of the 12 months.

The value of MKR went as little as $570 in September of this 12 months, the bottom in virtually two years for Maker. Nonetheless, after discovering support in that space, MKR has been in a correction.

Extra lately, the worth of MKR has elevated by round 100%, making Maker the most effective performers available in the market for the final 30 days. Purchaser sentiment has improved considerably as merchants are hopeful that this momentum might proceed within the coming days/weeks. Here’s a full record of among the greatest performers of this available in the market:

High 7 Day Good points | CoinMarketCap 🚀

🥇 Huobi Token $HT +76%

🥈 TerraClassicUSD $USTC +73.5%

🥉 Quant $QNT +16.7%

4. Ethereum Identify Service $ENS +14%

5. Hedera $HBAR +13.2%

6. Maker $MKR +9.7%

7. Terra $LUNA +8.1%#Crypto #CryptoNews #CoinMarketCap #TopGains pic.twitter.com/8sFQyprSUb— 🥷 Gokhshtein Media (@gokhshteinmedia) October 13, 2022

However earlier than we estimate how the worth of MKR can transfer, we have now gone by each the elemental and technical elements of Maker.

Maker (MKR) Technical Evaluation

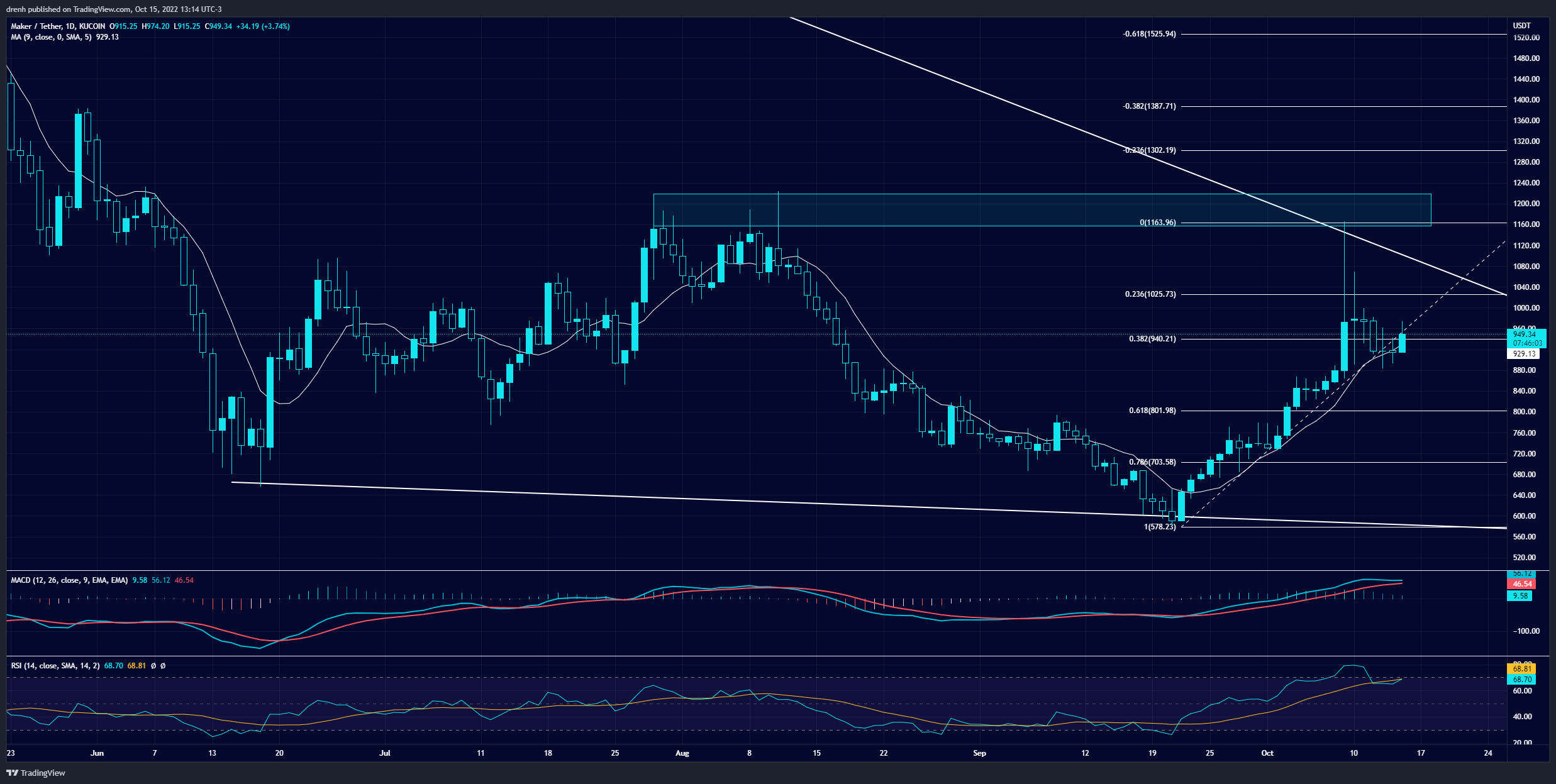

Maker has been on the rise within the 1-day chart. The value of Maker, nevertheless, failed to interrupt resistance at round $1160, which coincides with the earlier swing excessive of MKR.

When trying on the 1-day chart, we might discover a doable rounding backside sample. Furthermore, given the latest retracement of 24%, we might see a possible cup-and-handle sample kind, which might be an indicator of a possible breakout within the coming weeks.

The Fibonacci retracement ranges recommend that the worth of MKR has retraced to the 50% stage. Whereas this stage is just not well known as a Fibonacci stage, many analysts take the 50% stage as a legit stage that the worth can retrace. With shopping for stress nonetheless excessive, MKR might use this assist at $880 and intention for the next value. We might see MKR retest resistance within the coming days, different issues equal.

Indicators

The worry and greed index suggests that there’s comparatively much less worry for MKR merchants because of the latest improve within the value. The latest retracement has saved the worry issue fairly eminent, however the total sentiment has improved for Maker adherents.

The 20-MA of a 1-day chart is at present under the worth of MKR, suggesting that the short-term development is now bullish. The identical applies to the 9-EMA of a 1-day chart. The EMA line might momentarily act as assist to the worth if the latter makes an attempt to say no additional.

The RSI of a 1-day chart was lately above 70, making MKR overbought. Therefore, merchants anticipated the latest retracement. Nonetheless, now the worth is barely under 70, which means that the momentum stays bullish and that MKR might have extra space for development within the coming days.

The MACD line of a 1-day chart is above the sign line and above the baseline, which means that the momentum is sort of bullish for Maker (MKR). Nevertheless, the traces are at present converging because of the latest retracement, which means that the momentum might shift simply within the coming days.

Maker (MKR) Elementary Evaluation

There are numerous the reason why Maker has been performing nicely lately. One purpose might be that its important competitor is just not performing nicely. As chances are you’ll or might not know, Maker fuels the manufacturing of DAI tokens, which is a direct rival to UST and LUNA. Since UST is failing to re-peg to USD, making DAI in the end the higher deal out of the 2.

Based on specialists, another excuse for Maker’s latest improve in value is the elevated assist by institutional whalers. Statistics present that prime ETH whalers alone maintain thousands and thousands price of {dollars} of MKR tokens. Extra exactly, the highest 500 ETH whales at present maintain round $50 million price of MKR tokens.

Extra lately, MakerDAO has dedicated to investing $500 million in US treasuries and bonds to hedge the danger from this bear market by diversifying the stability sheet of the undertaking. Since Maker is a decentralized autonomous group (DAO), the choice was carried out by the decentralized governance that Maker has. Such measures had been perceived as crucial by many given the scandal that occurred with Terra (LUNA) and the UST stablecoin a number of months in the past.

One of many oldest DeFi tasks, MakerDAO, is setting apart $500 million in US Treasuries and company bonds because the digital-asset house faces an total bear market https://t.co/Fz75xBhINZ

— Bloomberg (@enterprise) October 6, 2022

MKR Value Prediction

Based mostly on this evaluation of Maker (MKR), we might anticipate the worth of MKR to extend within the coming days provided that it discovered assist at $880. The value of MKR might retest resistance within the coming days, and it might intention for round $1,500 within the coming days.

As for the longer run, MKR has lately hit the bottom level in virtually two years. Due to that, merchants might now argue that MKR has all of the house it wants for rising within the coming months. The undertaking in itself is sort of promising, and with extra institutional backing, we might see MKR for $5,000 within the coming months, ceteris paribus.

Takeaways

- Maker (MKR) elevated by 100% within the final 30 days.

- Technical elements recommend that MKR might improve within the coming days.

- Maker’s latest development might be attributed to the poor efficiency of UST in addition to ETH whalers which have pushed the worth of MKR upward.

- MKR might intention for $1,500 within the coming weeks, different issues equal.