Bitcoin (BTC) danced into uncharted realms this week, breaking obstacles with a triumphant surge that pushed its worth past the $73,000 mark.

The cryptocurrency world, as soon as once more, finds itself within the midst of an exhilarating value discovery section, propelled by an amalgamation of bullish indicators and a notable shift in investor sentiments.

Associated Studying: Cardano (ADA) Price Alert: Analyst Predicts 60% Rally In Next 7 Days

Large Gamers Dominate The Crypto Area

This week’s narrative unfolded on a stage dominated by two juggernauts of the monetary realm – BlackRock and MicroStrategy. BlackRock, the undisputed titan of asset administration, despatched ripples by means of the market by submitting with the SEC, outlining tentative plans to include spot Bitcoin ETFs into its World Allocation Fund.

Though in its infancy, this transfer has ignited hopes for heightened demand, particularly by means of BlackRock’s IBIT ETF, already wielding a considerable 204,000 BTC.

Enter MicroStrategy, the steadfast evangelist of Bitcoin methods. This company behemoth poured extra gasoline into the already blazing hearth by revealing the acquisition of an extra 12,000 BTC.

This transfer propelled MicroStrategy’s complete company Bitcoin holdings to an awe-inspiring 205,000. Such maneuvers by trade giants underscore the rising acceptance of Bitcoin as a respectable and influential asset class.

Whereas headlines could also be dominated by institutional energy strikes, peering into the intricate internet of on-chain knowledge reveals the fascinating tapestry of investor conviction.

Supply: IntoTheBlock

$520 Million In Bitcoin In Transit

IntoTheBlock’s change netflow metric showcased a major outflow of 4,470 BTC on March eleventh. This substantial transfer, valued at over $520 million, noticed cash making a pilgrimage from change wallets to chilly storage.

The implication is evident – buyers, regardless of reaching report highs, are taking part in the lengthy recreation, stashing their digital treasures in chilly storage quite than choosing fast earnings.

This strategic transfer, coupled with a surge in demand, paints a bullish image of provide and demand dynamics.

Whole crypto market cap at $2.6 trillion on the every day chart: TradingView.com

Drawing parallels from the pages of historical past, the current exodus from exchanges echoes an analogous occasion on February twenty seventh.

On that day, a netflow of 8,050 BTC correlated with a wide ranging 26% surge in costs inside 48 hours. If this historic rhyming persists, the current outflow may simply be the wind beneath Bitcoin’s wings, propelling it to overcome the $75,000 resistance stage within the imminent days.

Because the stage is ready for Bitcoin’s subsequent act, technical indicators be part of the ensemble, singing harmoniously within the refrain of a possible breakout.

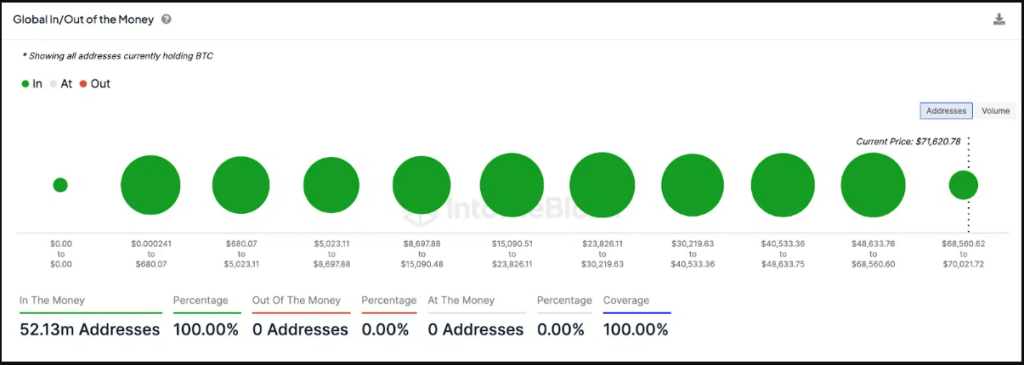

GIOM knowledge. Supply: IntoTheBlock

Having fun with Earnings

IntoTheBlock’s “World In/Out of the Cash” chart affords a visible feast, showcasing that on this period of Bitcoin’s value discovery, almost all the 52 million holder addresses are actually having fun with earnings. This absence of promoting strain, mixed with the rising institutional tide, paints a canvas of explosive potential.

Whereas the bulls eye the lofty goal of $75,000, technical evaluation factors to a possible assist station at $69,000.

This zone, a fortress the place over 6.6 million holders acquired almost 3 million BTC, might stand as a formidable psychological barricade within the face of any value pullback.

On the time of writing, Bitcoin is fast approaching the highly-coveted $74K stage, buying and selling at $73,529, up 2% and 10% within the every day and weekly timeframes, knowledge by Coingecko reveals.

Featured picture from Unsplash, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site completely at your personal danger.