- Bitcoin was down by greater than 5% within the final 24 hours.

- Market indicators hinted at a continued worth decline.

Bitcoin [BTC] continued to witness worth corrections, as its worth had dropped under the $66K mark at press time.

Although there have been a number of components at play, miners’ conduct might need impacted the king of cryptos’ worth extra negatively than traders realized.

Bitcoin miners are promoting

BTC turned bearish within the current previous as its worth dropped by over 5% within the final seven days. Within the final 24 hours alone, BTC’s worth witnessed one more 5% correction.

In response to CoinMarketCap, on the time of writing, BTC was buying and selling at $64,953.22, with a market capitalization of over $1.2 trillion.

Within the meantime, CryptoOnchain, an creator and analyst at CryptoQuant, posted an analysis stating that BTC’s miners’ reserves had been dropping.

To be exact, miners’ reserves have reached their lowest degree since April 2021, which means that miners had been promoting their holdings.

The evaluation talked about that this decline has been adopted by a a lot steeper slope for the reason that starting of November, which could have been one of many causes for rising gross sales strain available in the market.

To verify whether or not promoting strain was excessive total, AMBCrypto took a take a look at CryptoQuant’s data.

Our evaluation revealed that BTC’s web deposit on exchanges was excessive in comparison with the final seven-day common, suggesting excessive promoting strain.

BTC’s aSOPR was within the crimson, which means that extra traders had been promoting at a revenue at press time.

The king coin’s Binary CDD was additionally within the crimson, hinting that long-term holders’ actions within the final seven days had been larger than common.

Market sentiment appeared bearish, as evident by Bitcoin’s Coinbase Premium. Notably, the metric revealed that promoting sentiment was dominant amongst U.S. traders.

Its Korea Premium was additionally within the crimson, indicating that Korean traders had been promoting BTC, including to the general promoting strain.

Is an extra downtrend on its means?

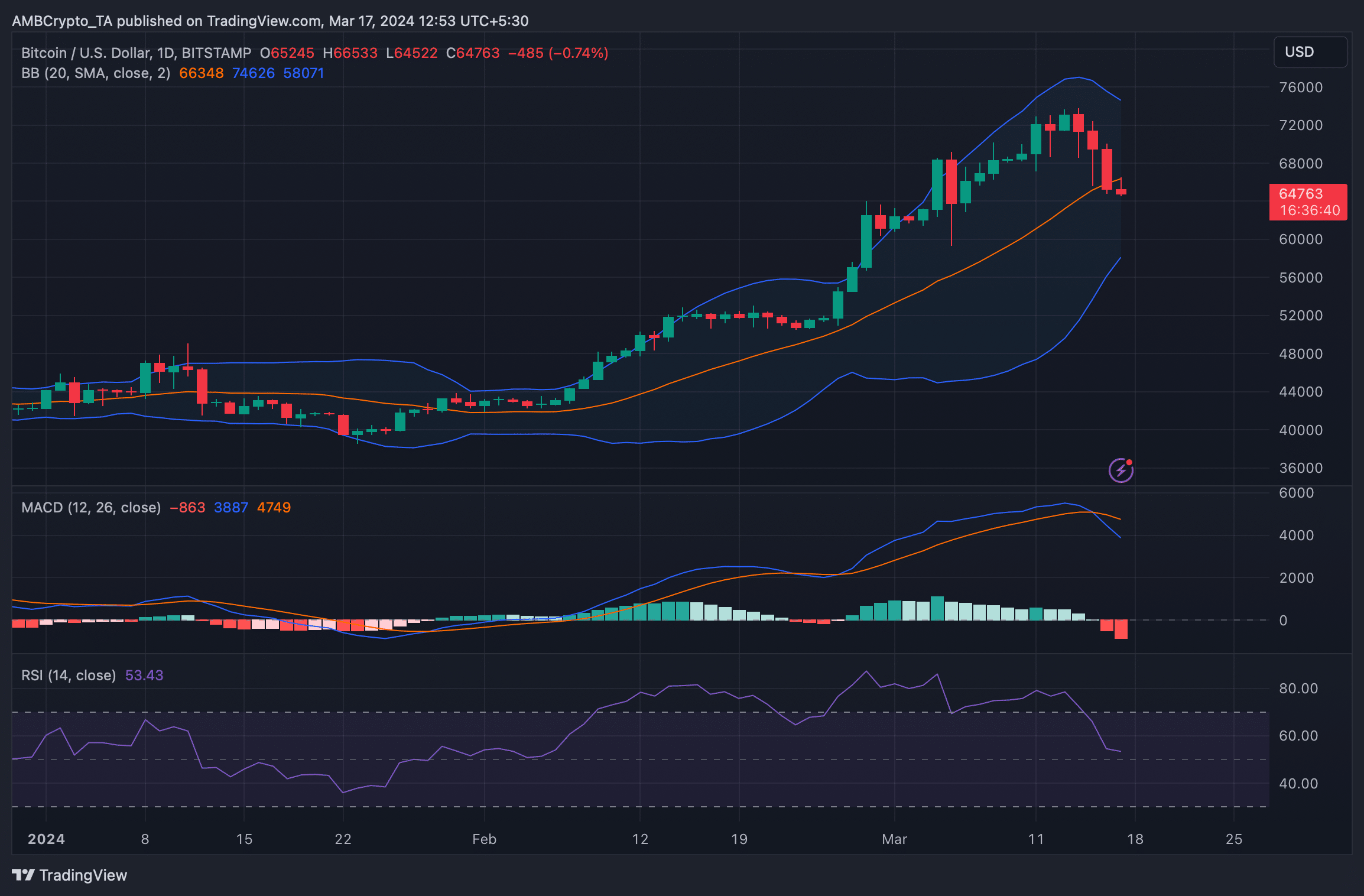

AMBCrypto’s evaluation of Bitcoin’s each day chart recommended that the opportunity of an extra worth decline was excessive. As per the Bollinger Bands, BTC’s rice went beneath its 20-day easy shifting common (SMA).

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Its MACD displayed a bearish crossover as nicely.

Additional, Bitcoin’s Relative Power Index (RSI) registered a pointy downtick at press time, hinting at a continued southward worth motion.