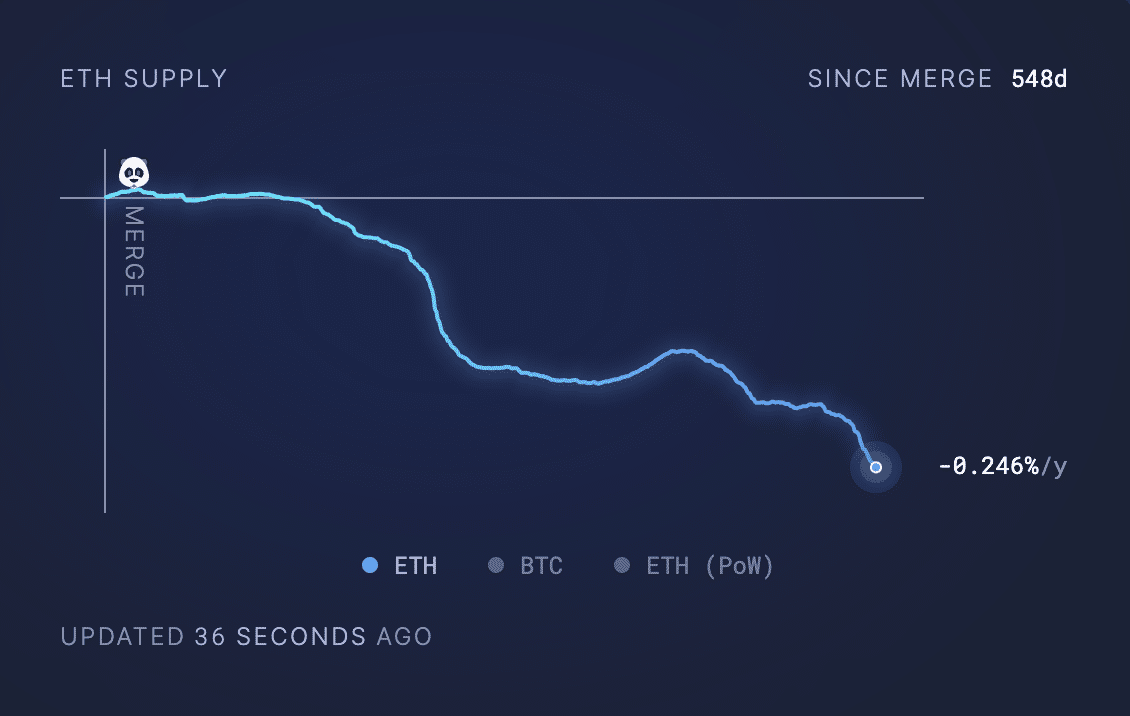

- Elevated demand for the Ethereum community has led to a surge in burn charge.

- This has led to a decline within the coin’s circulating provide.

Ethereum’s [ETH] circulating provide has fallen to a brand new post-merge low, in keeping with knowledge from Ultrasound.money.

Within the final month, 86,219 ETH value round $300 million on the altcoin’s press time worth has been faraway from circulation within the final 30 days.

The decline in ETH’s circulating provide confirmed that the Proof-of-Stake (PoS) community has seen an uptick in demand and use, inflicting its burn charge to extend.

AMBCrypto beforehand reported that the every day rely of latest addresses created on the Ethereum community just lately surpassed 116,000, a year-to-date (YTD) excessive.

This signaled a surge in person exercise on the Layer 1 (L1) community.

At press time, ETH’s circulating provide totaled 120.07 million ETH, the bottom degree in 548 days for the reason that community transitioned from Proof-of-Work (PoW), in an occasion popularly known as “The Merge.”

Ecosystem efficiency within the final month

An evaluation of Ethereum’s decentralized finance (DeFi) ecosystem revealed an uptick in complete worth locked (TVL) within the final month.

In line with DefiLlama’s knowledge, Ethereum’s TVL was $51 billion at press time, rising by 21% within the 30 days. Throughout that interval, Lido Finance, the main protocol on the chain, noticed its TVL improve by 27%.

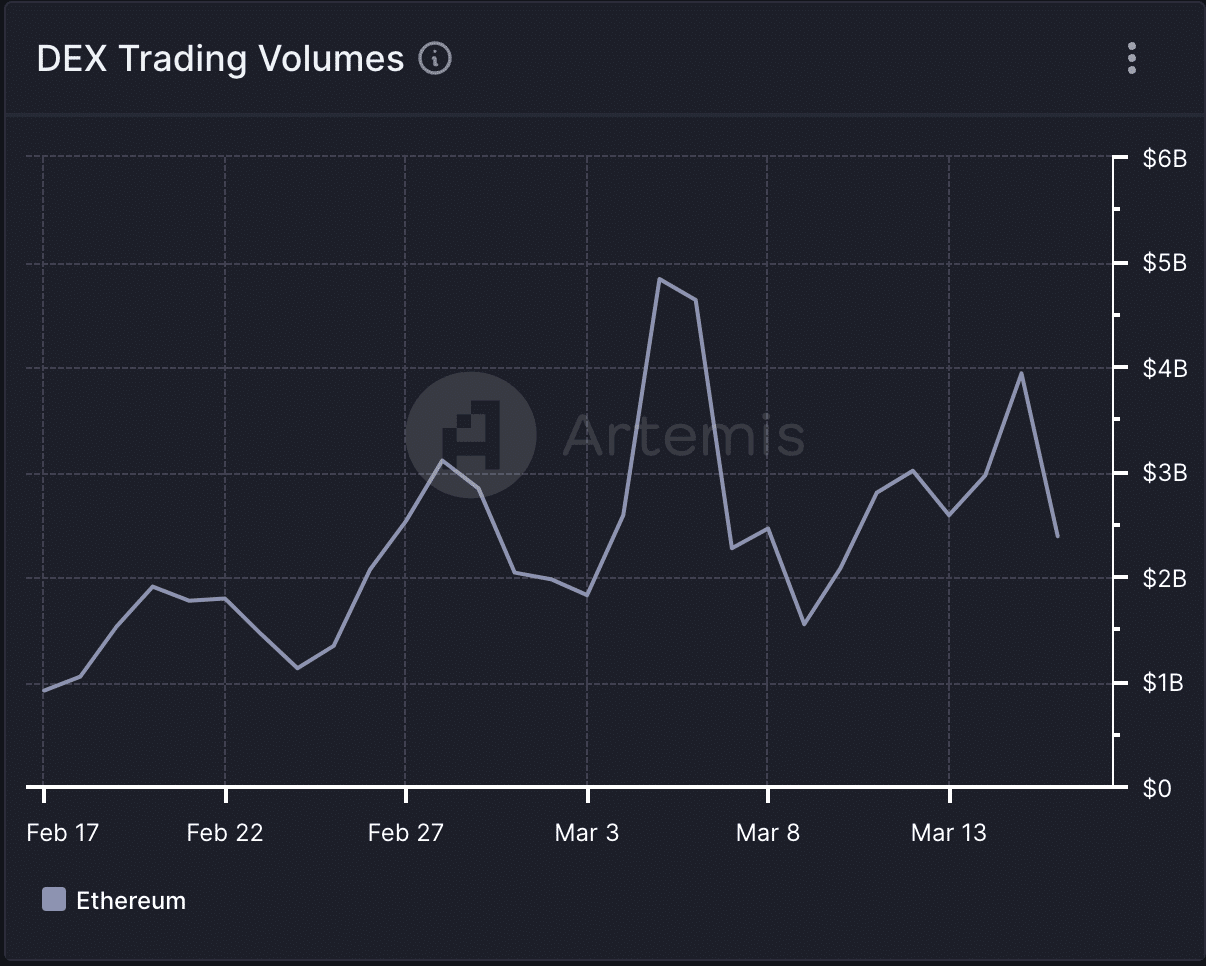

Amid the latest rally within the altcoin market, Ethereum witnessed a spike in its decentralized alternate (DEX) commerce volumes within the final month.

In line with knowledge from Artemis’, the every day buying and selling quantity throughout the DEXes housed inside Ethereum has risen by 161% prior to now 30 days.

Relating to the community’s non-fungible token (NFT) sector, it additionally witnessed progress within the final month.

In line with knowledge from CryptoSlam, NFT gross sales quantity totaled $617 million prior to now 30 days, registering a 17% rally.

This spike in buying and selling quantity occurred regardless of the 57% lower within the variety of NFT gross sales transactions accomplished throughout that interval.

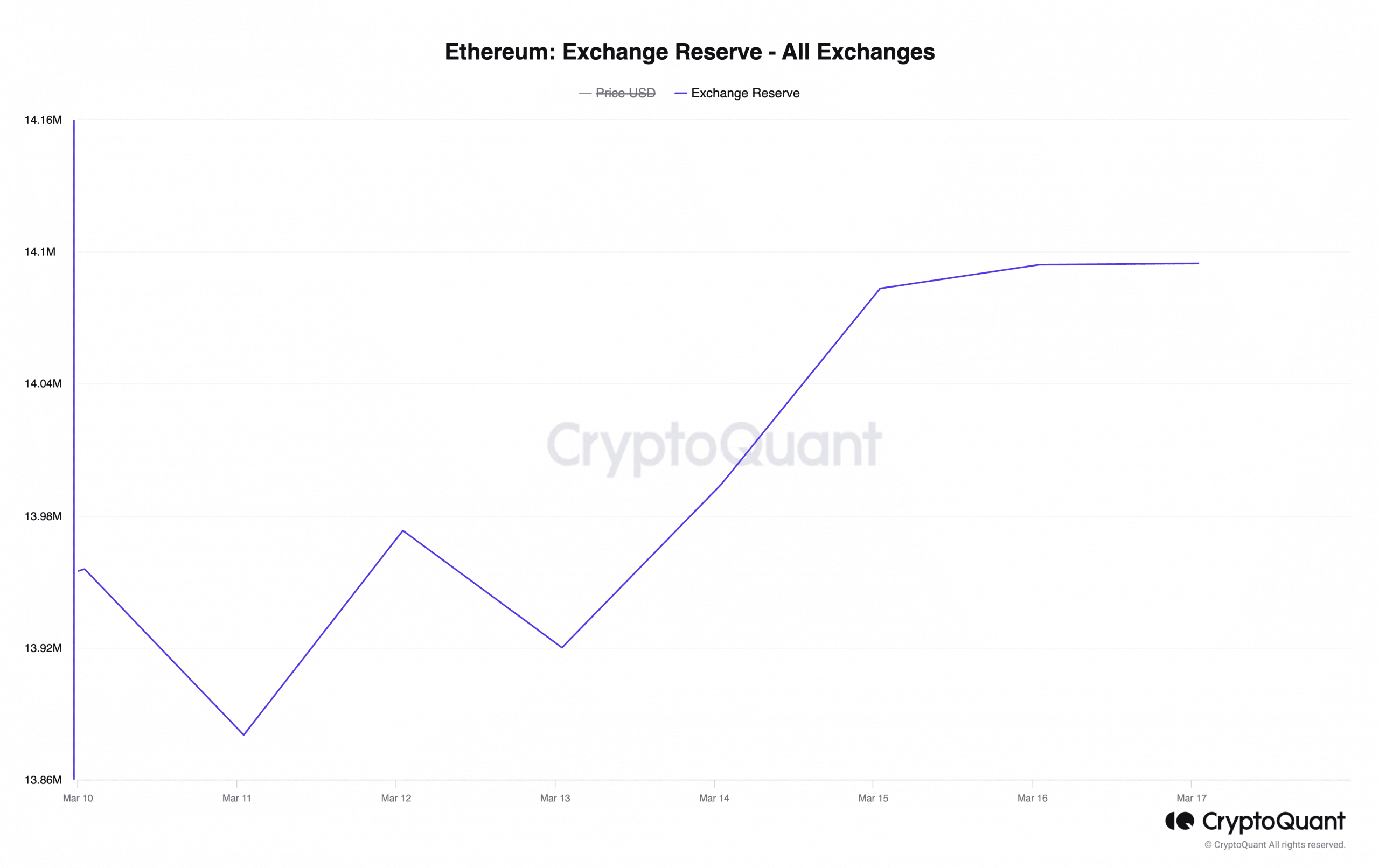

Change reserve climbs to a one-month excessive

Because the crypto market turns into considerably overheated, with the crypto worry & greed index indicating a marked improve in grasping sentiment, sell-offs of ETH have surged.

How a lot are 1,10,100 ETHs worth today?

This has resulted in a spike in ETH’s provide on exchanges. Per CryptoQuant’s knowledge, ETH’s alternate reserve was 14.1 million at press time, its highest degree within the final month.

When an asset’s alternate reserve climbs this fashion, it suggests a rise in promoting strain.