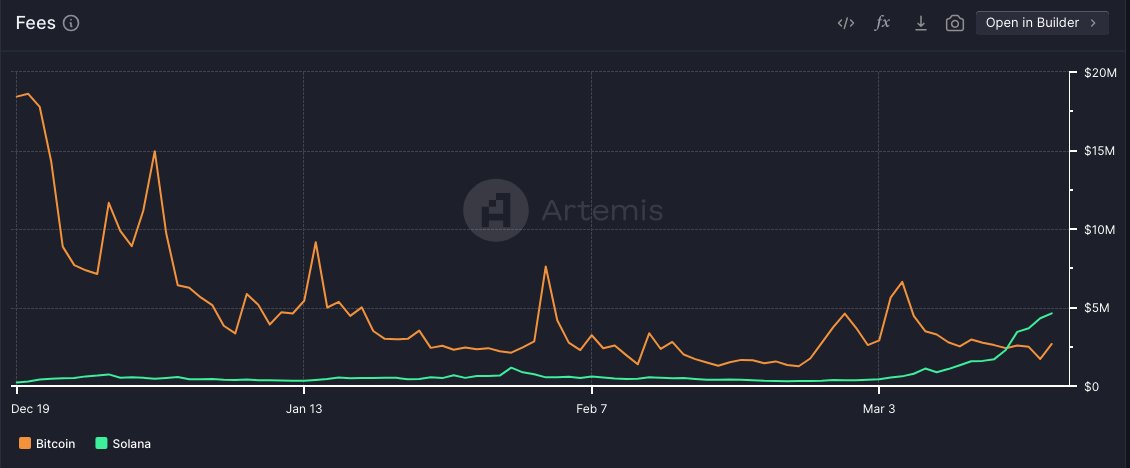

- Solana validator charges outpaced charges generated on the Bitcoin community.

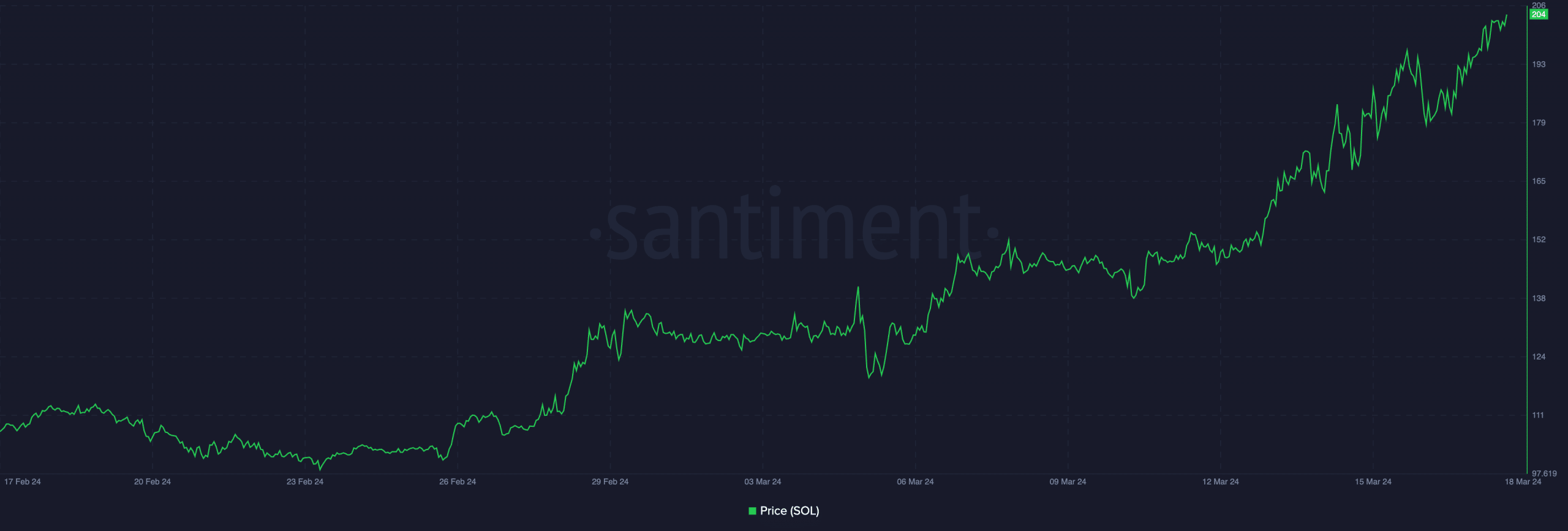

- Curiosity in staking SOL grew as value of SOL surged.

Solana [SOL] has surpassed numerous altcoins by way of exercise and transactions occurring on the community. Nonetheless, the community had began to indicate progress in different areas as properly. Information indicated that Solana was capable of go toe-to-toe with Bitcoin[BTC] by way of charges collected on the community.

Larger charges

Based on AMBCrypto’s evaluation of Artemis’ knowledge, Solana was blowing previous Bitcoin by way of charges generated for validators. The upper charges earned by Solana validators point out a surge in community exercise, suggesting elevated adoption and utilization of the platform.

The heightened exercise not solely demonstrates Solana’s scalability but additionally highlights its effectivity in processing transactions and executing sensible contracts.

Furthermore, the power to generate greater charges enhances the attractiveness of Solana for validators, incentivizing their participation and bolstering community safety and decentralization.

As Solana continues to outpace Bitcoin in payment era, it solidifies its aggressive place and underscores its potential as a number one blockchain platform, attracting extra builders, initiatives, and customers to its ecosystem.

Whereas greater charges could point out elevated community exercise, some buyers fear that Solana’s speedy progress could possibly be unsustainable or probably indicative of speculative habits.

There are additionally issues in regards to the scalability of Solana’s community and whether or not it may possibly deal with continued progress with out encountering technical challenges or bottlenecks.

Solana’s historical past with downtimes doesn’t assist with the sentiment across the community both.

Curiosity in staking

Aside from validator charges, there was a surge in curiosity noticed in Solana staking as properly. Evaluation of Dune Analytics knowledge revealed that there was a surge in TVL (Whole Worth Locked) staked via LST(Liquid Staking Tokens).

Jito was the most well-liked alternative for many stakers because it had captured 46.1% of the general market share.

The heightened participation in staking bolsters the safety and decentralization of the community by locking up extra SOL tokens as collateral. This elevated safety helps safeguard the integrity of transactions and enhances belief within the Solana protocol.

Moreover, staking SOL tokens permits holders to earn rewards.

How a lot are 1,10,100 SOLs worth today?

This fosters a tradition of long-term funding and helps in decreasing circulating provide, probably resulting in a extra steady token value over time.

Aside from SOL staking, curiosity was proven within the SOL token as properly. Within the final 24 hours, the value of SOL had surged by 10.46%.