Cryptocurrency lovers are buzzing after famend analyst Willy Woo ignited the group with a bullish prediction for Bitcoin (BTC). Woo, identified for his previous forecasting successes, suggests a monumental surge is on the horizon, fueled by a current growth – the long-awaited approval of spot Bitcoin ETFs.

These exchange-traded funds permit conventional buyers to realize publicity to Bitcoin with out the complexities of immediately buying and holding the digital asset. Woo believes this may act as a dam breaking, unleashing a torrent of capital into the cryptocurrency.

Bitcoin: Arrival On Main Exchanges Forges Ties With Conventional Markets

The normal markets maintain a staggering $100 trillion, Woo said on X (previously Twitter), and with Bitcoin now listed on among the world’s largest exchanges, we’re witnessing a bridge being constructed between these two monetary giants.

Jul 2010, BTC was 0.7 cents, it popped 10x in 5 days, then one other 1000x 2 years following.

Why?

BTC was launched to international liquidity with the arrival of MtGox.#Bitcoin simply obtained listed on the worlds inventory markets which holds ~$100T of capital, and they’re piling in. pic.twitter.com/m7yxyUudK7

— Willy Woo (@woonomic) March 7, 2024

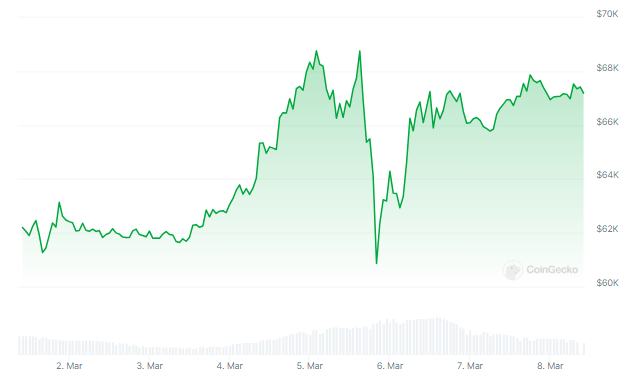

On the time of writing, Bitcoin was trading at $67,182, up 0.5% and eight.4% within the every day and weekly charts, information from Coingecko exhibits.

Bitcoin value motion within the weekly timeframe. Supply: Coingecko

He attracts parallels between the present state of affairs and the pivotal second in 2010 when Bitcoin discovered its footing on the Mt. Gox alternate platform.

This preliminary publicity to international liquidity propelled the fledgling digital asset to a tenfold enhance inside 5 days, adopted by a staggering 1,000x development over the following two years.

Echoes Of The Previous: Will Historical past Repeat Itself?

Woo argues that the present state of affairs presents an identical alternative, albeit on a a lot grander scale. He highlights the current all-time excessive of $69,000 for Bitcoin, adopted by a interval of stability that means resilience within the face of market corrections.

This, coupled with the constructive sentiment within the crypto group, paints an image ripe for a possible growth.

BTC market cap presently at $1.3 trillion. Chart: TradingView.com

Nevertheless, whereas the prospect of replicating Bitcoin’s astronomical rise in 2010 is undeniably alluring, it’s essential to do not forget that previous efficiency is just not a assure of future outcomes.

Technical evaluation charts, presently indicating an overbought market, could possibly be overwhelmed by the sheer quantity of capital influx predicted by Woo.

But, this state of affairs is just not with out its skeptics. Some analysts warning in opposition to overenthusiasm, mentioning that the technical indicators would possibly nonetheless play a job in figuring out the worth trajectory.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site solely at your personal danger.