- The Dencun improve is geared toward lowering charges to assist L2s develop additional.

- ETH’s worth motion remained bullish, as did market sentiment.

The look forward to Ethereum’s [ETH] much-talked-about Dencun improve is coming to an finish, as it’s scheduled to happen on the thirteenth of March.

The improve will deliver a number of adjustments to the blockchain, which will probably be particularly useful for the L2s.

For the reason that replace is across the nook, AMBCrypto deliberate to test how ETH was doing forward of the launch.

All about Ethereum’s Dencun improve

The Dencun improve would be the subsequent main replace for Ethereum after the Shapella improve that was pushed again in 2023.

For the uninitiated, the Dencun improve will execute two upgrades concurrently on Ethereum’s consensus and execution layers. The first focus of the improve is to drastically cut back charges to help Layer-2s development.

This will probably be made attainable because the builders will activate a brand new Ethereum Enchancment Proposal (EIP), which is called proto-danksharding.

Ethereum’s charges spike

Whereas builders ready to push the brand new improve, Ethereum’s community charges elevated.

AMBCrypto’s evaluation of Artemis’ data revealed that ETH’s charges gained upward momentum and spiked on the fifth of March. In consequence, ETH’s income additionally rose on the identical day.

A attainable cause behind this surge may very well be the hike in ETH’s gasoline worth, which stood at 64.39 Gwei per Ycharts.

Although issues appeared optimistic by way of captured worth, Ethereum’s community exercise had dropped. This was evident from the decline in its Each day Lively Addresses chart because the twenty ninth of February.

Due to the drop in addresses, ETH’s Each day Transactions fell as nicely.

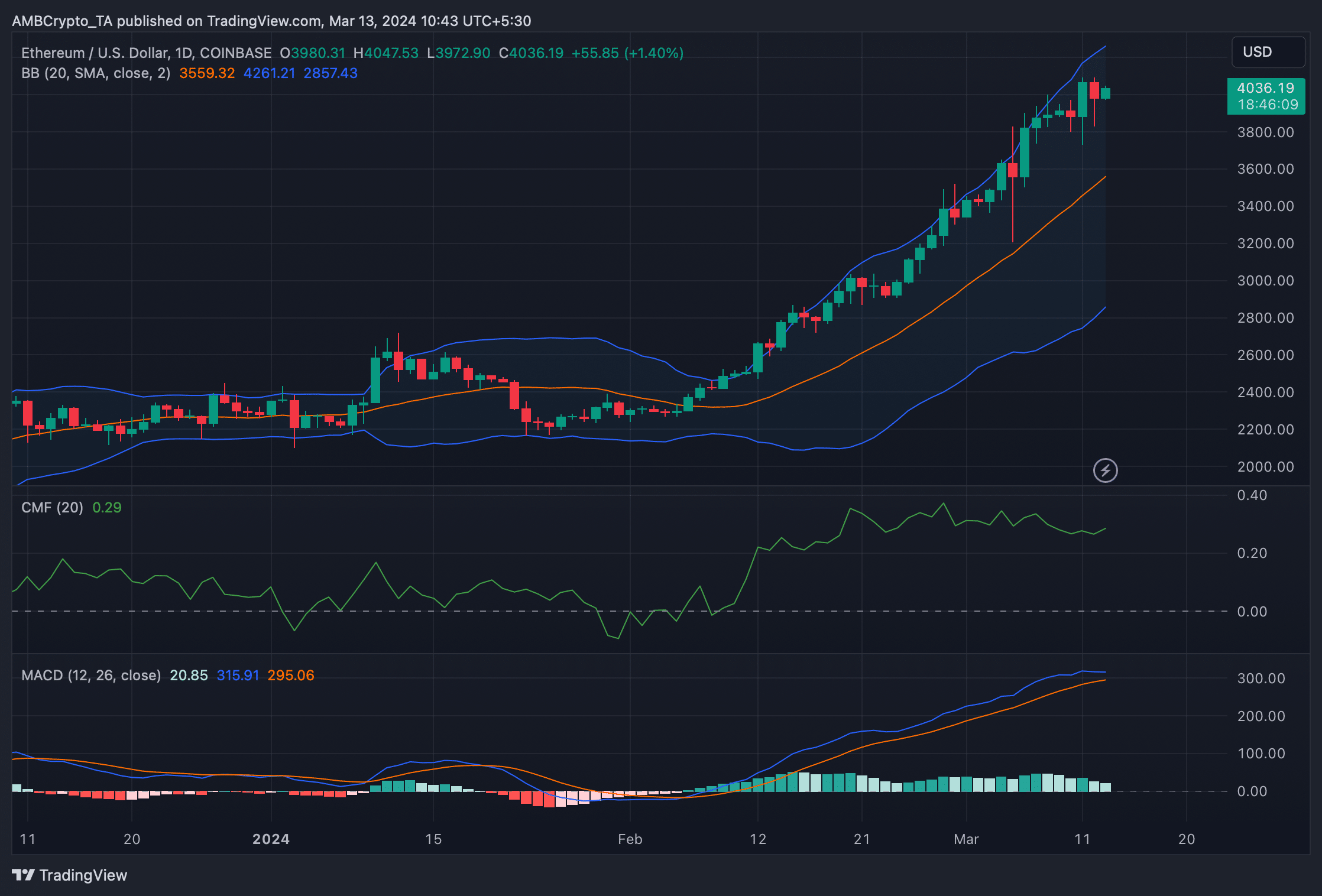

Nonetheless, Ethereum’s worth motion favored the bulls, because it was up by greater than 9% within the final seven days. On the time of writing, ETH was buying and selling at $4,034.42 with a market capitalization of over $484 billion.

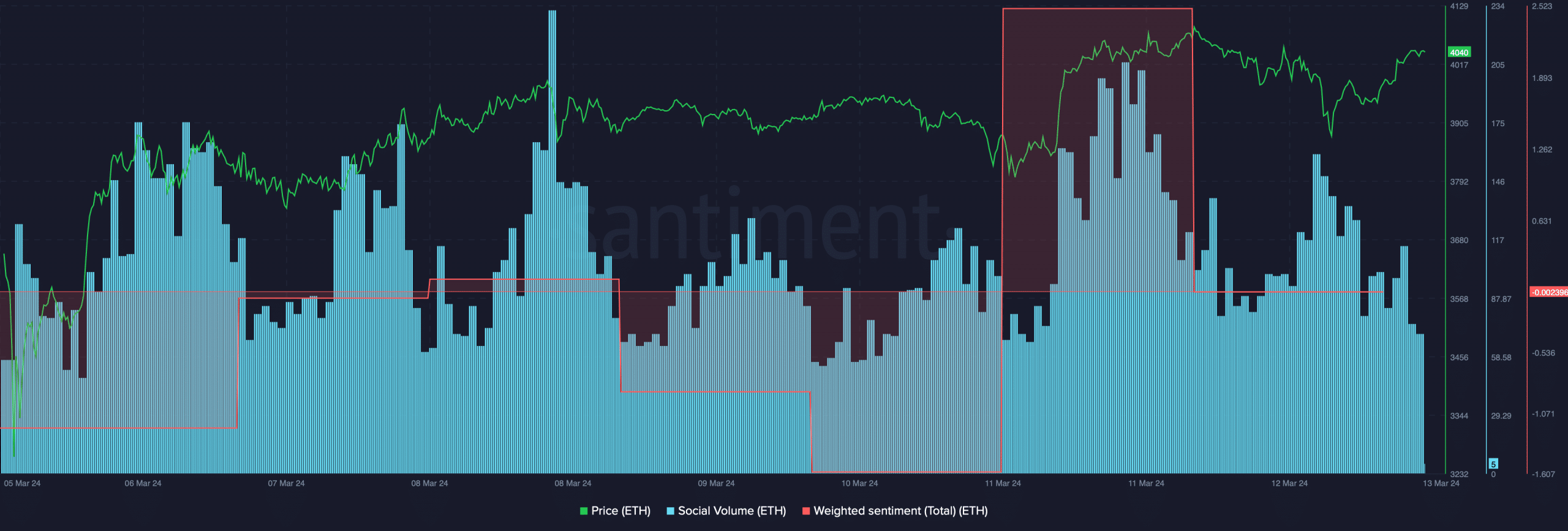

The king of altcoins additionally remained a buzzing matter of dialogue available in the market as its Social Quantity remained excessive.

Moreover, its Weighted Sentiment spiked, suggesting that bullish sentiment across the token was dominant at press time.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Other than that, the technical indicator MACD displayed a bullish higher hand available in the market. The Chaikin Cash Move (CMF) additionally registered an uptick, hinting at an additional rally.

Nonetheless, ETH’s worth had touched the higher restrict of the Bollinger Bands at press time, which indicated a worth correction.