- BTC was down by 5% within the final 24 hours.

- The king coin would possibly attain a brand new ATH by the tip of 2024.

Bitcoin [BTC] has been witnessing a number of worth corrections, which pushed the coin’s worth beneath $65k. Nonetheless, buyers should not lose hope, as BTC appeared to be following a historic worth development within the buildup to the halving.

So, if historical past repeats itself, BTC would possibly witness an additional worth drop earlier than it positive factors momentum and reaches $100k.

Bitcoin goes beneath $65k

After touching an all-time excessive, BTC’s worth was fast to plummet. In line with CoinMarketCap, BTC was down by over 10% within the final seven days.

In reality, within the final 24 hours alone, the king of cryptos’ worth dropped by over 5%. On the time of writing, BTC was buying and selling at $64,509.53 with a market capitalization of over $1.27 trillion.

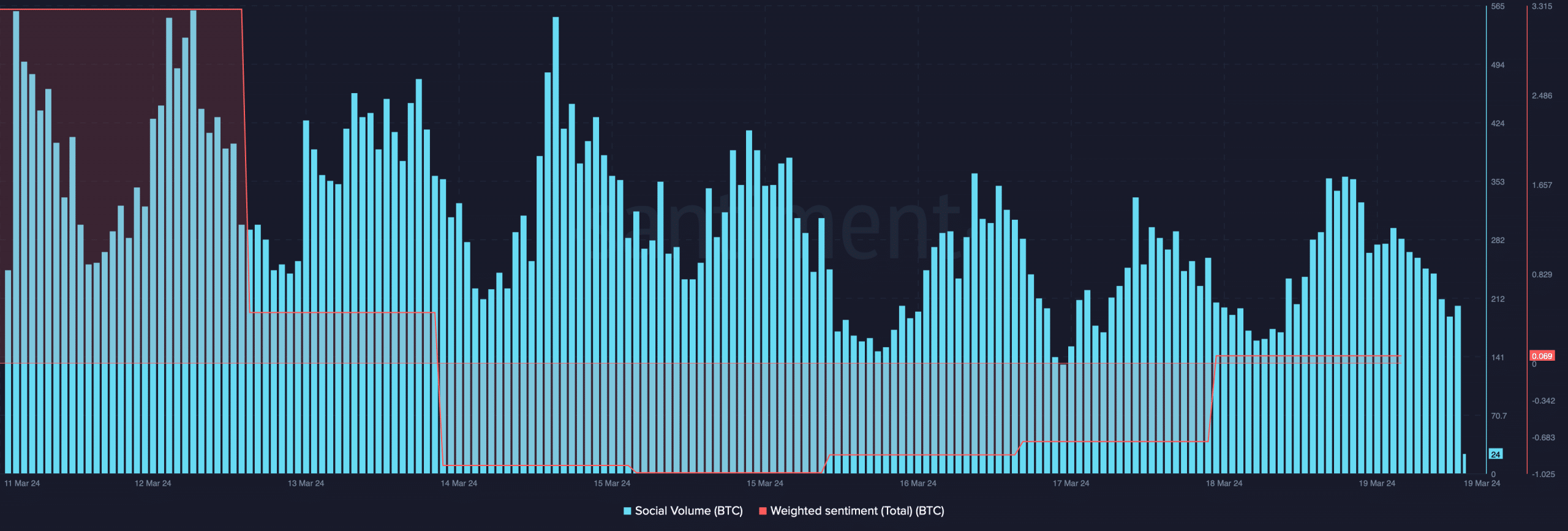

As a result of worth drop, Bitcoin’s Social Quantity declined, suggesting that its recognition considerably fell. Its Weighted Sentiment additionally dropped, which means that bearish sentiment across the coin was dominant.

Nonetheless, this declining development was not unexpected, as Rekt Capital posted an analysis concerning BTC following a historic development forward of its upcoming halving.

As per the evaluation, Bitcoin first entered the pre-halving rally part. Throughout that part, BTC managed to achieve an all-time excessive just a few days in the past.

The Pre-Halving Rally breakout was slightly forward of schedule by a handful of days. Nonetheless, Bitcoin was slowly transitioning away from its “Pre-Halving Rally” part and into its “Pre-Halving Retrace” part.

Will Bitcoin’s worth plummet additional?

Since Bitcoin entered the pre-halving retracing part, the possibilities of the coin registering an additional worth drop appeared possible. Rekt Capital’s tweet talked about that the pre-halving retrace tends to happen 28 to 14 days earlier than the halving occasion. The part resulted in 20% and 38% worth drops in 2020 and 206, respectively.

This time round, BTC would possibly as nicely contact $60k.

To examine whether or not that’s potential, AMBCrypto took a take a look at CryptoQuant’s data. Our evaluation revealed that BTC’s internet deposit on exchanges was excessive in comparison with the final seven-day common, indicating excessive promoting strain.

Two extra bearish indicators have been its SOPR and Binary CDD, as each of them have been pink, hinting at excessive promoting strain.

To examine how a lot the coin would possibly fall, AMBCrypto then took a take a look at its liquidation heatmap. As per our evaluation, BTC has sturdy help close to the $64,000 mark.

Subsequently, BTC’s worth would possibly rebound after touching that degree. Nonetheless, if it fails to check the help and falls beneath it, then the possibilities of BTC hitting $60k are excessive.

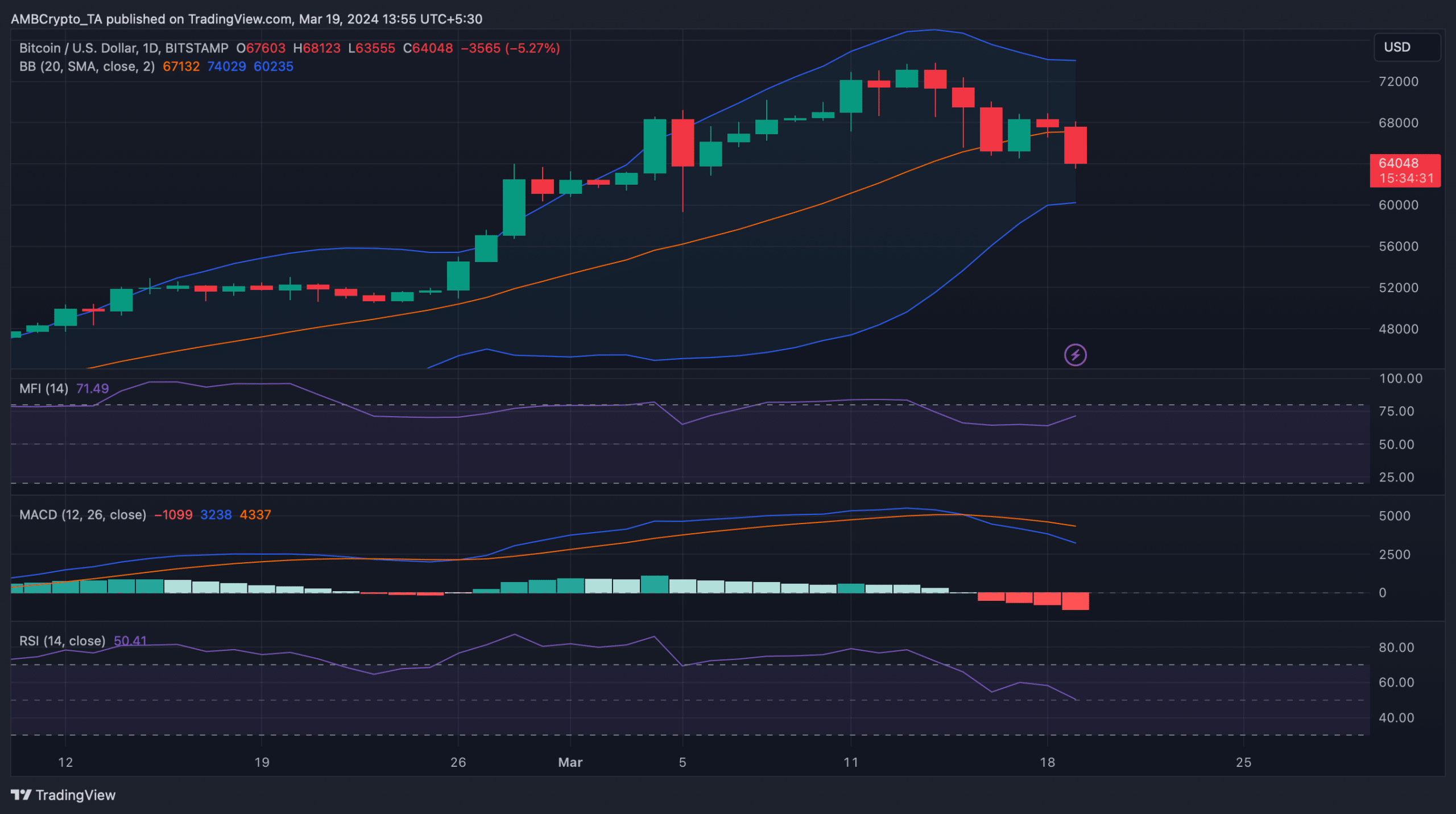

To raised perceive the possibilities of a continued worth drop, AMBCrypto checked Bitcoion’s every day chart. The king of cryptos’ Relative Power Index (RSI) registered a pointy downtick.

Its MACD additionally displayed a bearish benefit, suggesting that the coin’s worth would possibly decline additional within the coming days.

Nonetheless, the Cash Circulation Index (MFI) registered an uptick. As per the Bollinger Bands, BTC’s worth was in a much less unstable zone, which could forestall the coin’s worth from dropping additional.

Bitcoin would possibly contact $100k after halving

Although BTC’s worth would possibly witness yet one more worth correction, issues in the long run seemed bullish. Notably, after the pre-halving retrace part, BTC will enter the re-accumulation and parabolic uptrend phases.

The buildup part would possibly as nicely final for almost 5 months. Curiously, on this cycle, it will be the very first time that this re-accumulation vary may develop across the New All-Time Excessive space.

The evaluation talked about,

“Because of this, this re-accumulation vary might merely take the form of a daily sideways vary and should not final very lengthy earlier than further uptrend continuation.”

After that, BTC would enter the parabolic uptrend zone, which could permit BTC to create a brand new ATH. Traditionally, this part has lasted simply over a 12 months.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Nonetheless, with a possible accelerated cycle occurring proper now, this determine might get reduce in half on this market cycle.

Subsequently, buyers would possibly see BTC contact $100k throughout that part, which could occur on the finish of this 12 months.